Auto Insurance in and around Seattle

The first choice in car insurance for the Seattle area.

Insurance that won't drive you up a wall

Would you like to create a personalized auto quote?

Your Auto Insurance Search Is Over

On any given day when you are traveling on the interstate, you want to keep moving. Because falling objects or falling tree branches can happen to anyone, anytime, you need car insurance coverage you can depend on.

The first choice in car insurance for the Seattle area.

Insurance that won't drive you up a wall

Get Auto Coverage You Can Trust

Even better—reliable coverage from State Farm is possible for a wide array of vehicles, from scooters to motorcycles to pickup trucks to SUVs.

So don’t let a rollover or collisions stop you from moving forward!

Have More Questions About Auto Insurance?

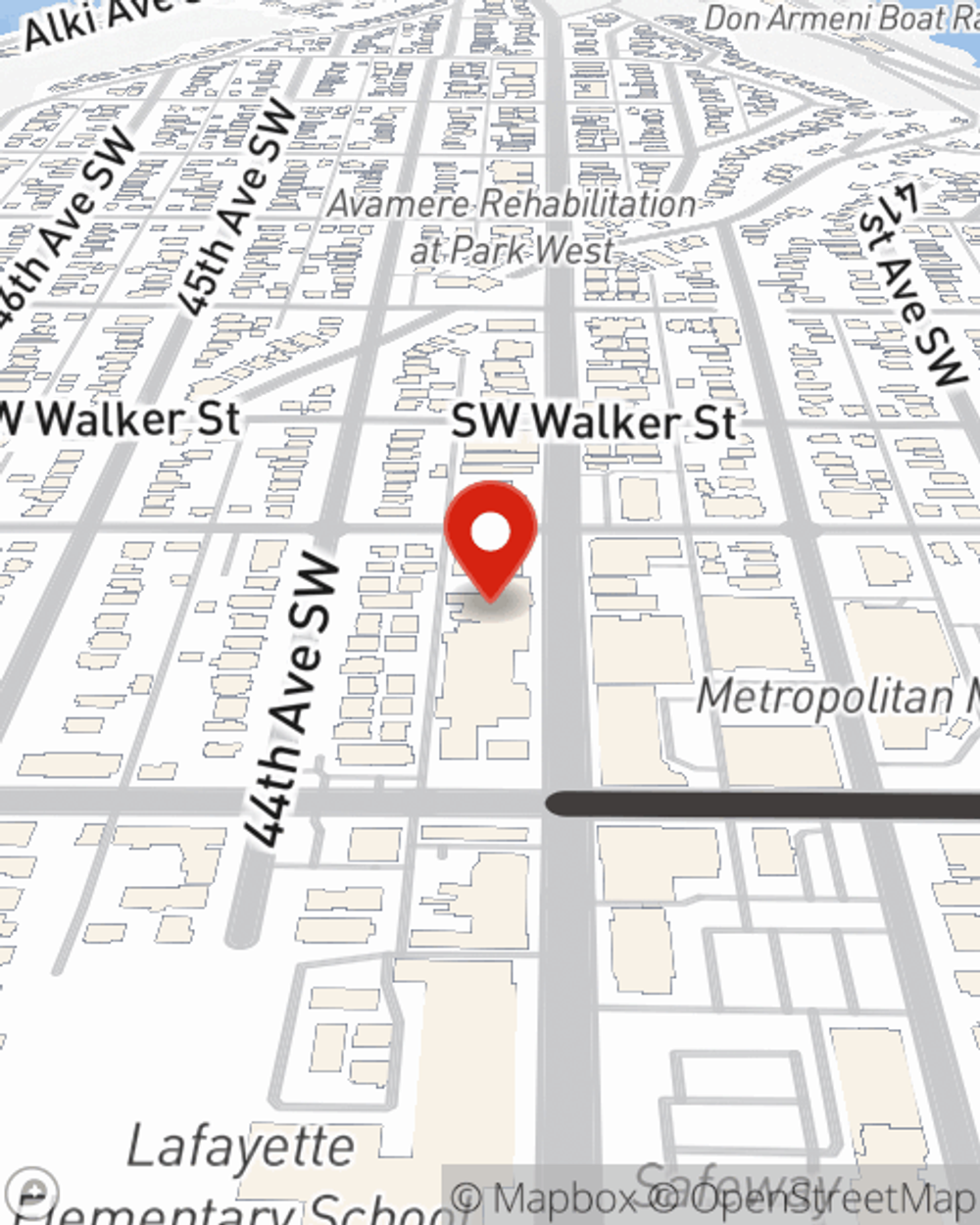

Call Brent at (206) 935-0499 or visit our FAQ page.

Simple Insights®

Teen driving 101: a step-by-step test of essential driving skills

Teen driving 101: a step-by-step test of essential driving skills

Learn some tips on how to teach a teen to drive in a safe manner. Also take a look at this skills checklist to see if your teen is ready to drive on their own.

Potentially save on auto insurance if you don't drive much: How pay-per-mile works

Potentially save on auto insurance if you don't drive much: How pay-per-mile works

Potentially save on car insurance with pay-per-mile plans that align costs with your actual driving. Learn who benefits most and how it differs from other usage-based plans.

Brent Amacher

State Farm® Insurance AgentSimple Insights®

Teen driving 101: a step-by-step test of essential driving skills

Teen driving 101: a step-by-step test of essential driving skills

Learn some tips on how to teach a teen to drive in a safe manner. Also take a look at this skills checklist to see if your teen is ready to drive on their own.

Potentially save on auto insurance if you don't drive much: How pay-per-mile works

Potentially save on auto insurance if you don't drive much: How pay-per-mile works

Potentially save on car insurance with pay-per-mile plans that align costs with your actual driving. Learn who benefits most and how it differs from other usage-based plans.