Business Insurance in and around Seattle

Calling all small business owners of Seattle!

Almost 100 years of helping small businesses

Help Prepare Your Business For The Unexpected.

Running a small business requires much from you. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, retailers, contractors and more!

Calling all small business owners of Seattle!

Almost 100 years of helping small businesses

Strictly Business With State Farm

Your business thrives off your commitment tenacity, and having outstanding coverage with State Farm. While you make decisions for the future of your business and support your customers, let State Farm do their part in supporting you with business owners policies, worker’s compensation and artisan and service contractors policies.

Since 1935, State Farm has helped small businesses manage risk. Visit agent Brent Amacher's team to review the options specifically available to you!

Simple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.

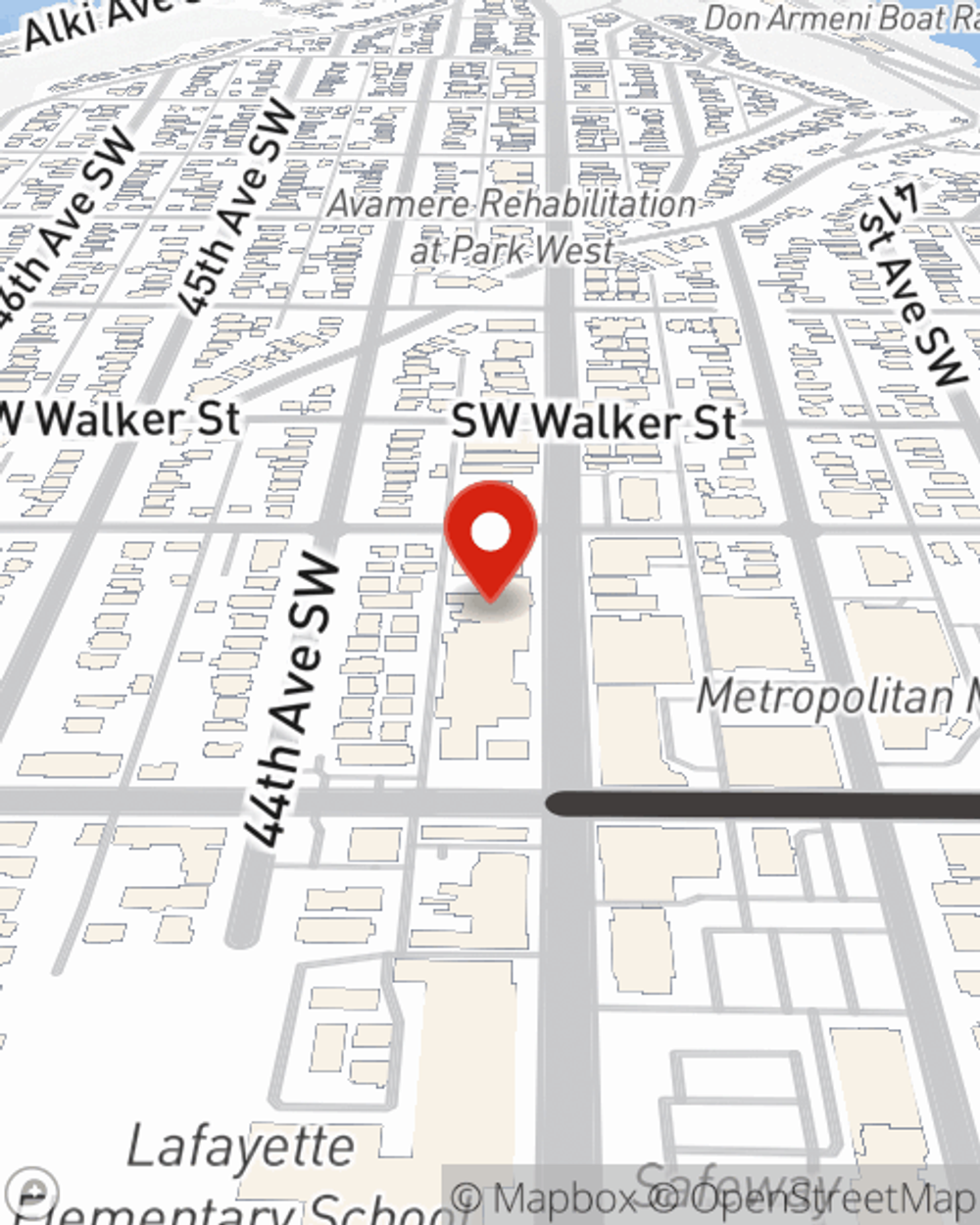

Brent Amacher

State Farm® Insurance AgentSimple Insights®

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

How to grow your small business

How to grow your small business

Growing a small business takes strategic planning and research. Consider these helpful tips on ways to grow a small business to help ensure future success.