Condo Insurance in and around Seattle

Unlock great condo insurance in Seattle

Insure your condo with State Farm today

Home Is Where Your Condo Is

Are you committing to condo ownership for the first time? Or have you owned one for a while? Either way, it can be a good idea to get coverage for your unit with State Farm's Condo Unitowners Insurance.

Unlock great condo insurance in Seattle

Insure your condo with State Farm today

Condo Coverage Options To Fit Your Needs

Things do happen. Whether damage from weight of sleet, vandalism, or other causes, State Farm has wonderful options to help you protect your condo and personal property inside against unexpected circumstances. Agent Brent Amacher would love to help you develop a policy that is personalized to your needs.

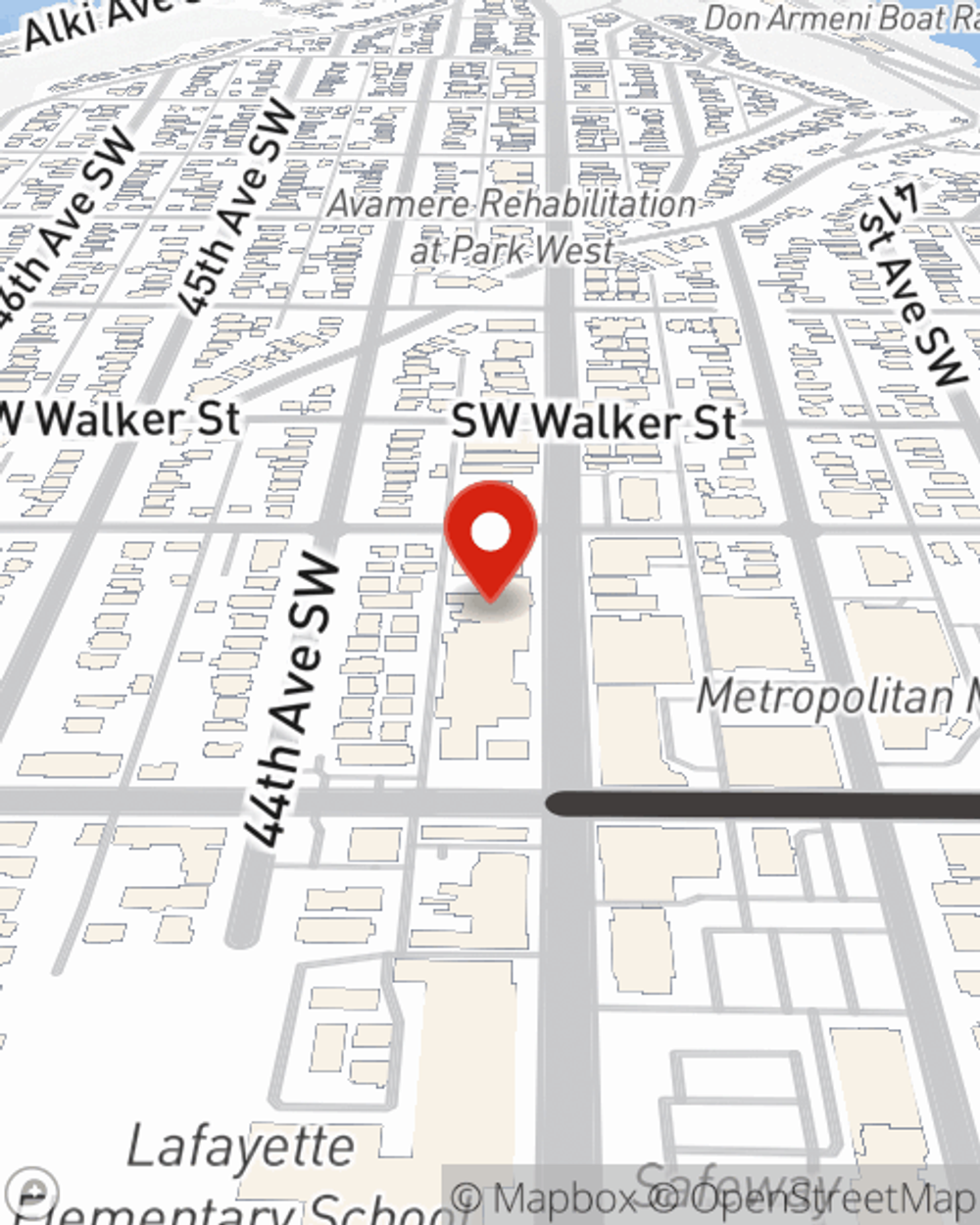

Getting started on an insurance policy for your condominium is just a quote away. Call or email State Farm agent Brent Amacher's office to learn more about your options.

Have More Questions About Condo Unitowners Insurance?

Call Brent at (206) 935-0499 or visit our FAQ page.

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.

Brent Amacher

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

10 Washing machine maintenance tips

10 Washing machine maintenance tips

Routine washer maintenance can help reduce breakdowns and costly water damage. Learn how to clean your washing machine and more.